Charting the Future of Virtual Care: From Access to Value

Can virtual care recover from its post-pandemic low?

I’m back! After a multiyear hiatus, I’m picking up the pen again to delve into the intersection of healthcare technology, virtual care, and value-based care. For those new here or returning, subscribe for more insights on these topics and revisit some of my previous thoughts like the Future of Virtual-First Healthcare.

A lot has changed in virtual care in the last 3 years. After the initial pandemic-fueled surge of virtual care, telehealth revenue has plateaued, once-celebrated unicorns have gone bankrupt, public company valuations collapsed, retail companies are retreating from care delivery, and many generalist investors are retreating from healthcare and tech-enabled services.

These shifts have prompted many observers to declare the death of virtual care. Nothing exemplifies the doom and gloom more than Teladoc’s stock, the telehealth darling whose stock has precipitously dropped since pandemic highs.

Is virtual care dead? The prevailing news cycle might lead us to think so. However, I believe we’re entering a new era of virtual care: one characterized by longitudinal, coordinated, value-based care that just happens to be delivered virtually. As someone frequently talking with plans and employers, I still see tremendous demand for high quality virtual care that actually moves the needle on outcomes and cost. Sophisticated healthcare investors keep a close pulse on the market and continue to deploy capital in virtual care companies that align with buyer and patient needs.

As we look to the future of virtual care, it’s important to consider how we got here, the shortcomings with current telehealth usage, and how the next generation of virtual care companies can solve those gaps. These will be the companies that win in the market.

The Dawn of Telehealth 1.0

In the 2000s and 2010s, the first wave of “Telehealth 1.0” digital health and telehealth companies emerged. The companies largely focused on access and experience, often employing one of two predominant models: digitally-enabled coaching for chronic conditions and virtual urgent care.

Digital Coaching for Chronic Conditions

The first model, exemplified by companies like Livongo and Hinge Health, leveraged health coaching as their primary care modality and focused on chronic conditions like diabetes. These platforms focused on guiding patients through lifestyle adjustments like exercise & nutrition, usually without the direct involvement of a clinician who could practice medicine and prescribe treatments.

Coaching-only solutions are particularly effective for conditions that do not require early medical intervention, like musculoskeletal (MSK) conditions. MSK conditions can often be treated without prescriptions, and instead with physical therapy and cognitive behavioral therapy. However, for complex conditions like diabetes where medical care is critical, coaching only solutions fragment care from the primary provider and ultimately lack all the necessary care elements to impact quality and cost. The Peterson Health Technology Institute’s analyses demonstrated this dichotomy with a positive evaluation for virtual MSK solutions and neutral or negative evaluation for digital diabetes solutions.

The lack of prescription authority and the fragmentation of care from clinicians limits the effectiveness of coaching only solutions to a small subset of conditions that don’t require comprehensive medical care. Despite that, throughout the pandemic, we saw many companies get funded with the pitch of being the “Livongo for X condition” – and many employers gobbled up these solutions.

Virtual Urgent Care

The second “Telehealth 1.0” model was spearheaded by companies such as Teladoc, Amwell, and MDLIVE, which offered medical care primarily targeted at urgent care needs. These companies excelled at rapidly connecting patients with a licensed healthcare provider in their state for “on demand” care.

These services were great for patients with urgent care needs that required one-off prescriptions, like cold sores, UTIs, BV, and birth control refills. Companies billed virtual care as a more convenient and lower-cost alternative to traditional urgent care centers – essentially, a site of service arbitrage. Data from Wheel’s 2024 Virtual Care Trends report indicates that many telehealth consultations are still for these “convenient care” needs.

Virtual urgent care companies generally provided on-demand, transactional care from a random 1099 clinicians; most did not support continuous, longitudinal care from an established clinician. The episodic & transactional nature of these care models limits their ability to effectively treat complex chronic conditions that require an ongoing patient-provider relationship. Most costs in the healthcare system are driven by chronic conditions or high-cost surgical episodes, not urgent care needs, which ultimately limits the benefit of transactional virtual urgent care to patients and payers.

The Limitations of Telehealth 1.0 Point Solutions

The pandemic caused a Cambrian explosion of Telehealth 1.0 point solutions targeting specific conditions, and many employers I talked to were managing well over 30 different point solutions targeting specific conditions. These companies often improve access to care and enhance the patient experience for a niche patient population, but, except in select companies, have limited data on their impact on clinical outcomes and total cost of care.

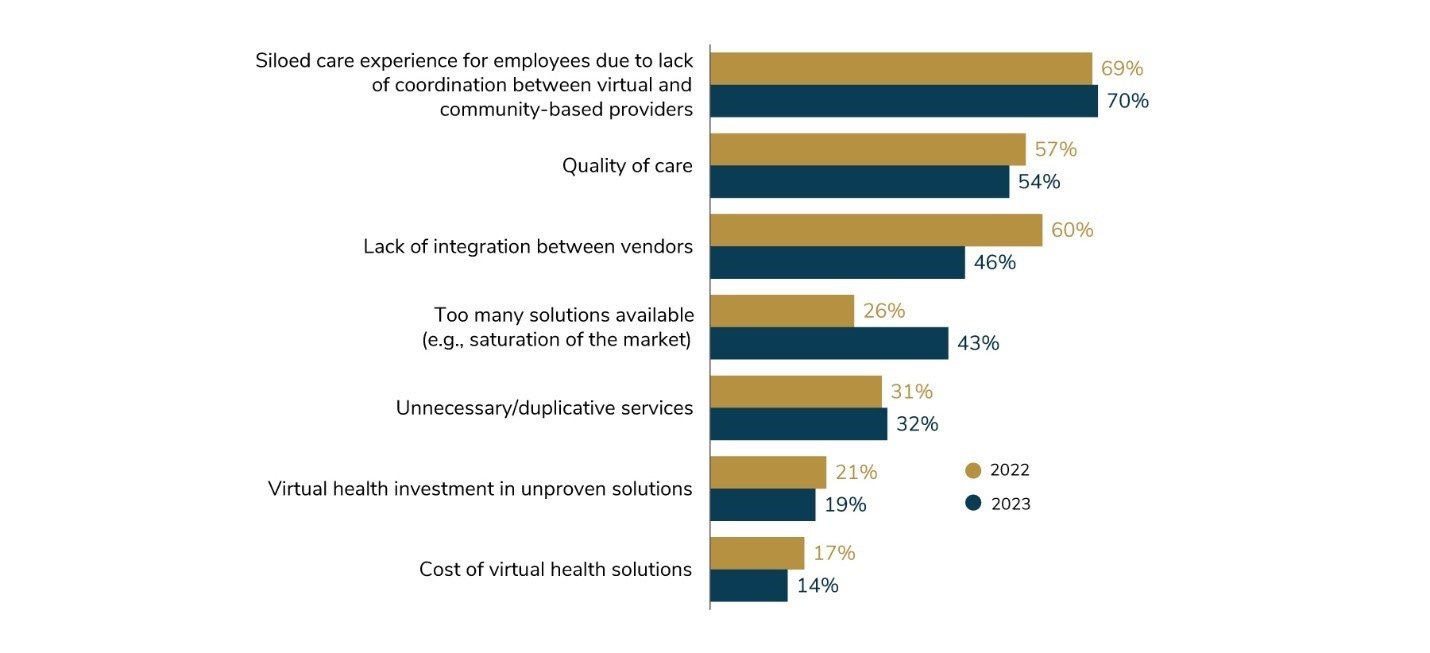

Overwhelmed by the complexity and inefficiency of managing multiple disjointed services that have questionable impact on outcomes, many employers are reassessing the necessity of condition-specific point solutions. Data from the most recent 2024 Business Group on Health survey show most large employers worry digital health solutions further fragment care delivery and question the quality of virtual care. The administrative complexity of managing these solutions resulted in what employers commonly call “point solution fatigue,” a term I can barely go a week without hearing now. Many are calling on their carriers to step up to manage and integrate these services.

Anecdotally, I’ve spoken with many Fortune 500 companies that are actively looking to remove point solutions without proven outcomes – some are even removing up to ¾ of their point solutions. Given their relatively limited scope of service and declining market sentiment, it’s no wonder that some (but not all!) Telehealth 1.0 companies are struggling.

The shortcomings of the early telehealth initiatives underscored the need for a more integrated, cost-effective approach to virtual care, setting the stage for the next evolution—Virtual-First Care (V1C). I continue to see strong demand from payers and employers for this type of care.

The Rise of Virtual-First Care (V1C)

I continue to see strong demand from payers and employers for virtual care services, but the market is transitioning away from Telehealth 1.0 companies to a new model termed Virtual-First Care (V1C). Virtual-first care companies deliver a new type of care, focused not only on improving access and patient experience, but also on delivering proven clinical outcomes and reducing the total cost of care. By focusing on the triple aim, companies can align incentives across patients, providers, and payers.

Key Features of Virtual-First Care

Virtual first care companies identify gaps that exist in today’s healthcare system for a specific condition or specialty (like OBGYN), create a novel care model designed explicitly to close those gaps, and deliver differentiated clinical & financial outcomes as a result of their novel care model. At the core, virtual first care is often a new and differentiated care model; that care just happens to be delivered virtually as a means to improve accessibility and convenience.

Virtual-First Care is characterized by several distinguishing factors that set it apart from the early Telehealth 1.0 companies:

Comprehensive Clinical Models: Unlike the singular condition focus of many early telehealth efforts, V1C companies approach patient care more holistically, addressing coexisting comorbid conditions through end-to-end care models.

Longitudinal Medical Care: In contrast to the transactional nature of Telehealth 1.0 companies, patients receive ongoing care from a dedicated team of in-house (often W2) clinicians, enabling the management of more complex conditions that require longitudinal care journeys.

Coordinated with In-Person Care: V1C companies provide seamless transitions between virtual and in-person care, including for labs, imaging, and surgical procedures (when required), enabling a true end-to-end care experience that reduces fragmentation of care.

Whole Person Support: Building on the coaching models of Telehealth 1.0, V1C incorporates whole person services like behavioral health, coaching, and nutrition into their care model, creating a more cohesive and integrated care experience.

Clinical Outcome Optimization: V1C companies systematically track and analyze patient data, allowing for more rapid cycle improvement in clinical outcomes.

Actuarial Rigor: Many V1C companies have extensive actuarial capabilities to ensure total cost of care reduction and enable value-based contracting.

Unlike earlier coaching-only models that often contracted with employers as vendors, V1C solutions often as a network provider health plans and are available not only to self-insured employers, but also to fully insured books of business. This model helps alleviate employers’ point solution fatigue and allows companies to more seamlessly work with local providers to reduce fragmentation of care. Driven by employers’ calls to consolidate point solutions, we’re seeing more and more health plans take note of this market trend by standing up best-in-class virtual first care vendors that come standard in an employer’s network.

Riding these market tailwinds, some Telehealth 1.0 companies are pivoting to virtual-first care, and many virtual urgent care companies are heavily investing in virtual primary care. New companies have also emerged to provide high quality, virtual-first care like my company, Visana Health, in women’s health, Oshi Health in digestive health, Boulder Care in substance use, and Vori Health in MSK.

The Challenges (and Opportunities) in Scaling Virtual-First Care

As promising as Virtual-First Care sounds, scaling an innovative care delivery model is no easy feat. Despite seeing strong demand, we’re still in early innings of V1C, with many payers & employers just now working through their strategy. As a founder of a scaling virtual-first care company, below are a few key challenges that we as an industry will have to overcome to chart a path forward to ensure V1C can reach its full potential.

Economic Sustainability: Investors remain skeptical of tech-enabled care delivery businesses’ margins and capital requirements, especially in a fee-for-service model. Fortunately, many new V1C companies grew up in a funding period where we were forced to think of profitability and margins from day 1, and a few key profitable business models have emerged, like using robust actuarial data demonstrating cost reduction to enable unique value-based contracting strategies.

Patient Adoption & Trust: In our market research at Visana, we’ve found many patients associate Virtual First Care with Telehealth 1.0 companies: episodic, designed for urgent care, and fragmented from the healthcare system. We need to build back trust with patients and demonstrate the value of V1C.

Seamless Integration with Brick & Mortar Care: As V1C scales, it’s imperative to have seamless data transfer to other clinicians in a patient’s care ecosystem. Provider groups are just now starting to invest in relationships with virtual-first care companies, and we’re slowly making progress towards interoperability with things like TEFCA – but we’re not there yet.

Regulatory Uncertainty: Government agencies are creating uncertainty around high-impact regulations, including the DEA limiting virtual prescriptions of controlled substances and the looming expiration of telehealth flexibilities in the 2023 Consolidated Appropriations Act on 12/31/24. More advocacy is needed.

Join the Conversation on the Future of Virtual-First Care

These challenges (and opportunities!) will shape the trajectory of Virtual-First Care for years to come. In future posts, I’ll dive deeper into these topics with a few guest writers, unpacking each of the barriers and what we can do to drive the field forward.

If these topics resonate with you and you’d like to chat, email me at joe@visanahealth.com.

Subscribe to stay informed about the future of virtual-first care. You’ll receive in-depth analyses on pivotal V1C topics and enjoy candid insights from leading V1C executives and VCs in the trenches of V1C every day. You can also follow me on LinkedIn for more frequent posts.

Thanks for the thoughtful article Joe. I couldn't agree more.